| ☐ | |||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule | ||

| 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount previously paid: | ||

| (2) | Form, Schedule, or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

| Savneet Singh | PAR Technology Corporation | |||||||

| Chief Executive Officer and President | 8383 Seneca Turnpike | |||||||

| New Hartford, NY 13413 | ||||||||

|

April 28, 2017[●], 2020

Dear PAR Technology CorporationFellow Stockholder:

I am pleased to invite you to PAR Technology Corporation’s 20172020 Annual Meeting of Stockholders, which willto be held on Friday,Thursday, June 9, 20174, 2020 at 10:00 a.m. (Eastern Time). In light of the coronavirus outbreak (COVID-19), the protocols that federal, state, and local time atgovernments have imposed and may impose, and in the Turning Stone Resort, Tower Meeting Rooms (Birch Room), 5218 Patrick Road, Verona, New York 13478.

You will be able to attend and participate in the compensation of our named executive officers, and acting upon such other matters as may properly come before thevirtual Annual Meeting or any adjournments or postponements thereof.

The attached Notice of record by a broker, bank, or other nomineeAnnual Meeting of Stockholders and you wish to voteProxy Statement describe the formal business that we will transact at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the virtual Annual Meeting, please vote your shares by telephone, by the Internet or, if you must obtainreceived a printed copy of the proxy issuedmaterials, by completing, signing and dating your proxy card and returning it in the envelope provided. Voting by proxy now, will not limit your name from that record holder.right to change your vote or to attend the virtual Annual Meeting.

On behalf of the Board of Directors, I would like to express our appreciation for your continued support, interest and investment in PAR Technology Corporation.

Sincerely,

![[MISSING IMAGE: sg_donald-foley.jpg]](https://capedge.com/proxy/DEF 14A/0001174947-17-000690/sg_donald-foley.jpg)

Savneet Singh, Chief Executive Officer & President

![[MISSING IMAGE: t1701283_parnyse-lr.jpg]](https://capedge.com/proxy/DEF 14A/0001174947-17-000690/t1701283_parnyse-lr.jpg)

| |

| PAR Technology Corporation | |

| 8383 Seneca Turnpike, New Hartford, NY 13413-4991 |

NOTICE OF

2017

2020 ANNUAL MEETING OF STOCKHOLDERS

Dear PAR Technology Corporation Stockholder:

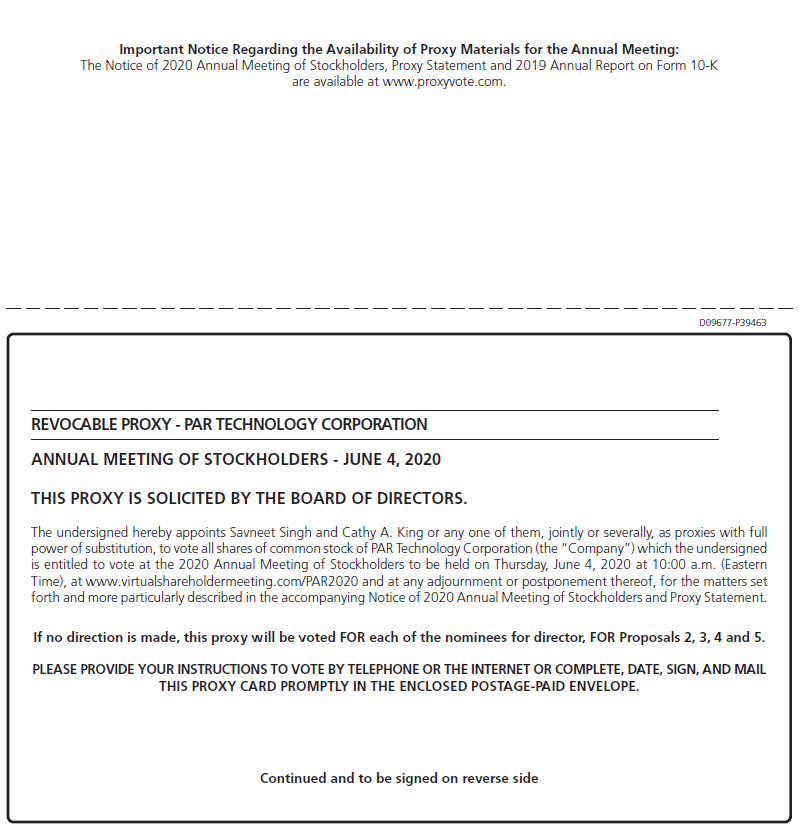

The 20172020 Annual Meeting of Stockholders (the “Annual Meeting”) of PAR Technology Corporation, a Delaware corporation (the “Company”, “PAR”, “we”, “us”, or “our”) will be held as follows:

Date: | Thursday, June 4, 2020. |

Time: | 10:00 a.m. (Eastern Time). |

Virtual Meeting: | In light of the coronavirus outbreak (COVID-19), the protocols that federal, state, and local governments have imposed and may impose, and in the best interests of the health and well-being of our stockholders, employees and directors, the Annual Meeting will be a completely virtual meeting; there will be no physical meeting location. |

| To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or on your proxy card or the voting instruction form. Stockholders will be able to vote and submit questions during the Annual Meeting. You will not be able to attend the Annual Meeting in person. | |

Place: | Virtual-only via the Internet at www.virtualshareholdermeeting.com/PAR2020. |

Record Date: | April 8, 2020. |

Items of Business: | To elect the five Director nominees named in the accompanying Proxy Statement to serve until the 2021 annual meeting of stockholders; |

| To approve, on a non-binding, advisory basis, the compensation of our named executive officers; | |

| To approve an amendment to our Certificate of Incorporation to increase the authorized shares of common stock from 29,000,000 to 58,000,000; | |

To approve an amendment to the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan to increase the number of shares of common stock issuable under the plan; | |

To ratify the appointment of Deloitte & Touche LLP as our independent auditors for 2020; and | |

| To transact other business that may properly come before the Annual Meeting or any adjournments or postponements thereof. |

A complete list of registered stockholders will be available at least 10 days prior to the Annual Meeting or any adjournments or postponements thereof.at our corporate headquarters, 8383 Seneca Turnpike, New Hartford, New York 13413. This list will also be available to stockholders of record during the Annual Meeting for examination at www.virtualshareholdermeeting.com/PAR2020.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to Be Held on Friday,Thursday, June 9, 20174, 2020 at 10:00 a.m. local time at the Turning Stone Resort, in Verona, New York.(Eastern Time) As of the date of mailing of the.

This Notice of Internet Availability2020 Annual Meeting of Stockholders, Proxy Materials, all stockholdersStatement, and beneficial owners will have the ability to access all of our proxy materials2019 Annual Report on a website referenced in the Notice of Internet Availability of Proxy Materials.Form 10-K are available at www.proxyvote.com.

By Order of the Board of Directors,

![[MISSING IMAGE: sg_donald-foley.jpg]](https://capedge.com/proxy/DEF 14A/0001174947-17-000690/sg_donald-foley.jpg)

Savneet Singh,

Chief Executive Officer and President

New Hartford, New York

April 28, 2017[●], 2020

Whether or not you expectplan to attend the virtual Annual Meeting, please vote over theyour shares by telephone, orby the Internet or, if you receivereceived a printed copy of the proxy materials, by completing, signing and dating your proxy card by mail, by completing and returning it in the envelope provided. Voting by proxy card, as promptly as possible in ordernow, will not limit your right to ensurechange your representation atvote or to attend the virtual Annual Meeting. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials or, if you receive a proxy card by mail, the instructions are printed on your proxy card. Even if you have voted by proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

| 1 | |||||||

| 1 | |||||||

| 15 | |||||||

| 15 | |||||||

| 17 | |||||||

| 36 | |||||||

i

PAR Technology Corporation

8383 Seneca Turnpike

New Hartford, NYNew York 13413-4991

April 28, 2017[●], 2020

2020 ANNUAL MEETING OF STOCKHOLDERS

To be held June 9, 20174, 2020

This Proxy Statement is being furnished to the stockholders of PAR Technology Corporation, a Delaware corporation, in connection with the solicitation of proxies by our Board of Directors for use at our 20172020 Annual Meeting of Stockholders to be held on Friday,Thursday, June 9, 20174, 2020 at 10:00 a.m. local time(Eastern Time) virtually via the Internet at the Turning Stone Resort, Tower Meeting Rooms (Birch Room), 5218 Patrick Road, Verona, New York 13478.www.virtualshareholdermeeting.com/PAR2020. This Proxy Statement and the proxy and voting instruction card or Notice of Internet Availability of Proxy Materials are first being sent or made available to our stockholders on or about April 28, 2017.[●], 2020.

Who is entitled to notice and to vote at the Annual Meeting?

Only stockholders of record of our common stock at the close of business on April 24, 2017,8, 2020, the Record Date, are entitled to notice of, and to vote at, the Annual Meeting. On April 24, 2017,8, 2020, there were 15,774,604[●] shares of common stock outstanding. Each share of common stock is entitled to one vote.

Distribution of Proxy Materials; Notice of Internet Availability of Proxy Materials (the “Notice”).

As permitted by the rules of the Securities and Exchange Commission (“SEC”), on or about April 28, 2017,[●], 2020, we sent the Notice to our stockholders as of April 24, 2017.8, 2020. Stockholders will have the ability to access the proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2016,2019, on the Internet at www.investorvote.com/PARwww.proxyvote.com or to request a printed or electronic set of the proxy materials at no charge. Instructions on how to access the proxy materials over the Internet and how to request a printed copy may be found on the Notice, and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. The Notice also instructs you on how to vote through the Internet or by telephone.

Who is paying for this proxy solicitation?

We are paying the costs of the solicitation of proxies. We will reimburse brokers, banks or other custodians, nominees and fiduciaries for their charges and expenses in forwarding proxy materials to beneficial owners. Certain of our Directors, officers and employees, without additional compensation, may also solicit proxies on our behalf in person, by telephone, or by electronic communication. In addition, we have engaged Morrow Sodali LLC to assist in the solicitation from brokers, bank nominees and institutional holders for a fee of $8,000 plus out-of-pocket expenses.

Stockholder of Record; Shares Registered in Your Name.Name.

If on April 24, 20178, 2020 your shares were registered directly in your name, then you are a stockholder of record and you may vote in personon the matters to be voted upon at the Annual Meeting, vote by proxy over the Internet or by phone by following the instructions provided in the Notice or, if you request and received printed copies of the proxy materials by mail, you may vote by mail.Meeting. If your proxy is properly executed in time to be voted at the Annual Meeting, the shares represented by the proxy will be voted in accordance with the instructions you provide. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting virtually via the Internet at www.virtualshareholdermeeting.com/PAR2020and vote in personyour shares if you have already voted by proxy.proxy (see “Can I change my vote after submitting my proxy?” below).

Beneficial Owners; Shares Registered in the Name of a Broker, Bank, or Other Nominee.Nominee.

If on April 24, 20178, 2020 your shares were not registered in your name, but rather in the name of a broker, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The broker, bank, or other nominee holding your sharesorganization, which is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial

owner, you have the right to direct your broker, bank, or other nominee regarding how to vote your shares. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the virtual Annual Meeting unless you request and obtain a valid proxy from your broker, bank, or other nominee.

Participating in the Virtual Annual Meeting.

This year, the Annual Meeting will be a completely virtual meeting. There will be no physical meeting location.

The meeting will be conducted via an audio webcast. To participate in the virtual Annual Meeting, visit www.virtualshareholdermeeting.com/PAR2020 and enter the 16-digit control number included on your Notice or on your proxy card or the voting instruction form. You may begin to log into the meeting platform beginning at 9:45 a.m., Eastern Time, on June 4, 2020. The Annual Meeting will begin promptly at 10:00 a.m., Eastern Time, on June 4, 2020.

If you wish to submit a question during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/PAR2020, type your question into the “Ask a Question” field, and click “Submit.”

Matters to be voted on at the Annual Meeting.Meeting.

We are two matters scheduled for a vote:asking our stockholders to consider and vote on the following matters:

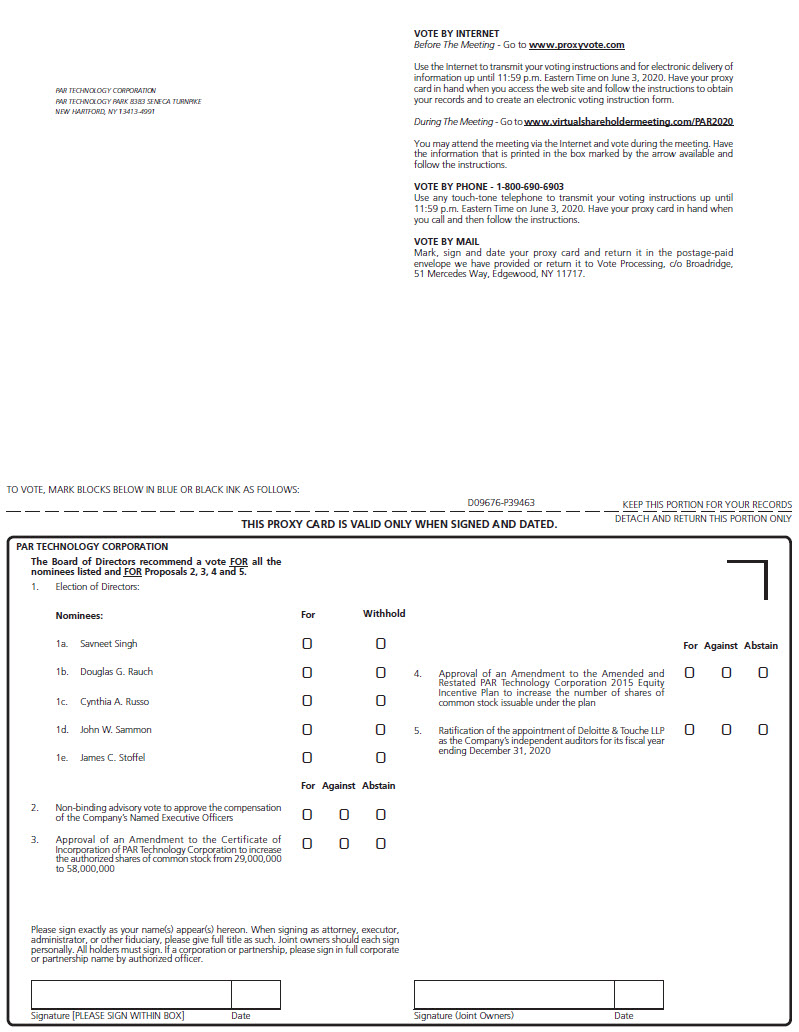

| • | Proposal 1: | Election of the five Director nominees named in this Proxy Statement to serve until the 2021 Annual Meeting of Stockholders; |

| • | Proposal 2: | Approval, on a non-binding, advisory basis, of the compensation of our named executive officers; |

| • | Proposal 3: | Approval of an amendment to our Certificate of Incorporation to increase the authorized shares of common stock from 29,000,000 to 58,000,000; |

| • | Proposal 4: | Approval of an amendment to the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan to increase the number of shares of common stock issuable under the plan; |

| • | Proposal 5: | Ratification of the appointment of Deloitte & Touche LLP as our independent auditors for 2020; and |

Other business, if properly raised.

2

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. However, ifIf any other matters are properly brought before the Annual Meeting, it is the intention ofindividuals named on the persons namedproxy card will vote your shares in the accompanying proxy to votetheir discretion on those matters in accordance with their discretion.such matters.

How do I vote my shares?

Stockholders may vote their shares over the Internet, by telephone or during the Annual Meeting by going to www.virtualshareholdermeeting.com/PAR2020. If you requested and/or received printed proxy material, including a printed version of the proxy card, you may also vote by mail.

| • | By Internet (before the Annual Meeting). You may vote at www.proxyvote.com, 24 hours a day, seven days a week. You will need the 16-digit control number included on your Notice or on your proxy card or the voting instruction form. Votes submitted through the Internet must be received by 11:59 p.m., Eastern Time, on June 3, 2020. |

By Telephone. You may vote using a touch-tone telephone by calling 1-800-690-6903, 24 hours a day, seven days a week. You will need the 16-digit control number included on your shares:

By InternetMail: To. If you received printed proxy materials, you may submit your vote throughby completing, signing and dating the Internet, go to www.investorvote.com/PAR or scanproxy card received and returning it in the QR code with your smartphone. Your Internet vote must be received by 3:00 a.m., Eastern Time, on June 9, 2017 to be counted.prepaid envelope.

| • | During the Annual Meeting. You may vote during the virtual Annual Meeting by going to www.virtualshareholdermeeting/PAR2020.com. You will need the 16-digit control number included on your Notice or on your proxy card or the voting instruction form. If you previously voted via the Internet (or by telephone or mail), you will not limit your right to vote online at the Annual Meeting. |

Can I change my vote after submitting my proxy?

Yes, if you are a stockholder of record, you can revoke your proxy at any time before the final voteprior to its exercise at the Annual Meeting by:

Submitting another completed and signed proxy card bearing a later date;

Granting a subsequent proxy by telephone or through the Internet;

Giving written notice of revocation to PAR Technology Corporation’s Corporate Secretary prior to or atSecretary; and

Attending the Annual Meeting; and

Your most current proxy card or telephone or Internet proxy is the one that isvote will be counted.

If you are a beneficial owner of shares registered in the name of a broker, bank, or other nominee, you will need to follow the instructions provided by your broker, bank, or other nominee as to how you may revoke your proxy.

What constitutes a quorum?

A majority of the shares of our common stock outstanding and entitled to vote on April 24, 2017 is necessary8, 2020 must be present at the Annual Meeting to constitute a quorum and to conduct business at the Annual Meeting.

counted for purposes of establishing a quorum. An “abstention” representsoccurs when a stockholder’s affirmative choice to declinestockholder affirmatively declines to vote on a proposal. AbstentionsA broker non-vote occurs when shares held by a broker, bank or other nominee in “street name” are counted as present and entitlednot voted with respect to one or more proposals because the nominee did not receive voting instructions from the beneficial owner of the shares on non-routine proposals for which the nominee lacks discretionary voting power to vote for purposesthe shares.

What vote is required to approve each proposal?

| Proposal | Voting Options | Vote Required | Effect of Vote s | ||||||

1 | Election of Directors | “For” or “Withhold” | A plurality of votes cast (which means the five Director nominees receiving the most “For” votes will be elected) | “Withhold” votes and broker non-votes will have no effect on the results | |||||

2 | Advisory Vote to Approve the Compensation of our Named Executive Officers | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions and broker non-votes will have no effect on the results. This advisory vote on executive compensation is non-binding on the Board | |||||

3 | Amendment to our Certificate of Incorporation to Increase the Authorized Shares of Common Stock from 29,000,000 to 58,000,000 | “For”, “Against” or “Abstain” | A vote “For” by a majority of all outstanding common stock | Abstentions will have the same effect as a vote against the proposal Brokers, banks and other nominees have discretionary authority to vote on this proposal | |||||

4 | Amendment to the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan to Increase the Number of Shares of Common Stock Issuable under the Plan | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions will have the same effect as a vote against the proposal Broker non-votes will have no effect on the results | |||||

5 | Ratification of Deloitte & Touche LLP as our Independent Auditors for 2020 | “For”, “Against” or “Abstain” | A vote “For” by a majority of votes cast | Abstentions will have no effect on the results of the vote Brokers, banks and other nominees have discretionary authority to vote on this proposal. | |||||

What if I return a proxy card but do not make specific choices?

All properly signed proxies returned in time to be counted at the Annual Meeting will be voted by the named proxies at the Annual Meeting. Where you arehave specified how your shares should be voted on a stockholder of record on April 24, 2017 and matter, your shares will be voted in accordance with your instructions; if you return a properly executed, timely received and unrevokedsign your proxy card, without marking any voting selections,but you do not indicate how your shares should be voted on a matter, your shares will be voted:

At the Annual Meeting stockholders will vote to elect five Directors to serve until the 2018 Annual Meeting of Stockholders; and

The following table sets forth information about the Company’s Directors as of April 24, 2017, which are theand Director nominees:

| Director | | | Age | | | Director Since | | | Positions and Offices | | | Independent(1) | |

| Paul D. Eurek | | | 57 | | | 2014 | | | | | | Yes | |

| Dr. Donald H. Foley | | | 72 | | | 2016 | | | Chief Executive Officer and President of PAR President of ParTech, Inc. | | | No | |

| Cynthia A. Russo | | | 47 | | | 2015 | | | | | | Yes | |

| Dr. John W. Sammon | | | 78 | | | 1968 | | | | | | No | |

| Todd E. Tyler | | | 54 | | | 2014 | | | | | | Yes | |

| Director | Age | Director Since | Positions and Offices | Independent(1) | ||||

Savneet Singh | 36 | 2018 | Chief Executive Officer and President of the Company and President of ParTech, Inc. | No | ||||

Douglas G. Rauch | 68 | 2017 | Yes | |||||

Cynthia A. Russo | 50 | 2015 | Yes | |||||

John W. Sammon | 81 | 1968 | No | |||||

James C. Stoffel | 74 | 2017 | Yes |

(1) | Independent under the listing standards of the New York Stock Exchange (NYSE) and our Corporate Governance Guidelines. |

The Board of Directors unanimously recommends a vote “For” the election of each of the above Director nominees.nominees.

Directors and Director Nominees

Below are summaries of the background, business experience and description of the principal occupation of each Director and Director nominee.

Cynthia A. Russo. Ms. Russo ishas more than 25 years of experience in financial and operations management with global, growth technology companies. From September 2015 to September 2018, Ms. Russo served as the Executive Vice President and Chief Financial Officer of Cvent, Inc. (NYSE: CVT), a position she has held since September 28, 2015. Cvent is a cloud-based enterprise event management platform provider offering solutions to event planners for online event registration, venue selection, eventprovider. As Chief Financial Officer, Ms. Russo led Cvent’s financial and business operations, reporting, planning and analysis, directed the senior management mobile applications, email marketingteam, and web surveys.oversaw a 200-person staff. From April 2010 until December 2014, Ms. Russo served as Executive Vice President and Chief Financial OfficerCFO of MICROS Systems, Inc., a provider of integratedglobal, public enterprise information system software, hardware and services company for retail and hospitality industries. During her 19 years at MICROS, Ms. Russo served in a variety of senior financial roles of increasing responsibility, from Director of Financial Reporting to Senior Vice President, Corporate Controller, and ultimately to CFO, which she served as for the last five years until MICROS’ acquisition by Oracle in September 2014. Since June 2019, Ms. Russo has served as a director of Verra Mobility Corporation (NASDAQ: VRRM), a leading provider of smart mobility technology solutions toand services throughout the hospitalityUnited States, Canada and retail industries. On September 8, 2014, MICROS became an indirect, wholly-owned subsidiary of Oracle Corporation.Europe, where she serves on the Audit and Compensation Committees. Ms. Russo is a Certified Public Accountant and Certified Internal Auditor. Ms. Russo brings financial acumen, risk management and organizational management proficiencies. Ms. Russo is a member ofproficiencies to the Audit Committee (Chair), Compensation Committee and Nominating and Corporate Governance Committee of our Board of Directors, and serves as the presiding Director at executive sessions of the independent Directors.Board.

Savneet Singh. Mr. Singh’s biographical information is the fatherset forth below under “Executive Officers”.

James C. Stoffel. From 2006 Mr. Stoffel has been a senior advisor to private equity and board member of Karen E. Sammon,multiple public companies. From 2011 to 2019 he also served as Co-Founding General Partner of Trillium International, a private equity firm focused on growth equity investments in technology companies. From 1997 – 2005, Mr. Stoffel held various senior executive positions at Eastman Kodak Company, including as Senior Vice President, Chief Technical Officer; Director of StaffResearch and Development; and Vice President, Director Electronic Imaging Products Research and Development. Prior to Eastman Kodak Company, Mr. Stoffel had a 20-year career with Xerox Corporation, serving as Vice President of the CompanyCorporate Research and John W. Sammon, III,Technology; Vice President and General Manager of the SureCheck business within the Company’s restaurant and retail business segment, operated through the Company’s wholly-owned subsidiary ParTech, Inc.

Executive Officers

The following table sets forth information about our executive officers as of April 24, 2017.officers.

| Name | Age | Positions and Offices | |||||

Savneet Singh | 36 | Chief Executive Officer, President, and Director of the Company and President of ParTech, Inc. | |||||

Bryan A. Menar | 44 | Chief Financial Officer and Vice President of the Company | |||||

Matthew R. Cicchinelli | 56 | President of PAR Government Systems Corporation |

Bryan A. Menar. Mr. Menar joined the Company as Chief Financial Officer and Vice President on January 3, 2017. From January 2015 to January 2017, Mr. Menar served as Vice President, Financial Planning and Analysis of Chobani, LLC, a producer of Greek Yogurt products based in Central New York. In this role, Mr. Menar was responsible for corporate financial analysis, including forecasting, budgeting, business reviews and financial presentations for both internal and external stakeholders and partners. From October 2012 to December 2014, Mr. Menar served as Director of Financial Planning and Analysis for Chobani. In addition, Mr. Menar served as a consultant with J.C. Jones & Associates, a national business consulting firm, from 2010 to 2012, and as Vice President, Merchant Bank Controllers, of Goldman Sachs & Co. from 2002 –- 2010. Mr. Menar is a Certified Public Accountant.

Matthew R. Cicchinelli. Mr. Cicchinelli was named President of PAR Government Systems Corporation and Rome Research Corporation effective December 12, 2015. Mr. Cicchinelli joined PAR in 2011 as Executive Director for Operations, and in 2013 was promoted to Vice President, Intelligence, Surveillance and Reconnaissance (“ISR”) Innovations. Prior to joining PAR, Mr. Cicchinelli served in various senior roles with the United States Marine Corps and the Department of Defense with a focus on command and control, ISR technologies, and strategic plans and policies. Mr. Cicchinelli retired from the Marine Corps in 2011 with the rank of Colonel.

Director Independence. Each of our Directors, other than Dr.John Sammon and Dr. Foley,Savneet Singh, has been determined by the Board to be “independent” under the listing standards of the New York Stock Exchange (“NYSE”), as supplemented by our Corporate Governance Guidelines, which are substantially similar to and consistent withmeets the listingadditional independence standards of the NYSE including considerations of material business and familial relationships, previous employment considerations and auditor affiliations. Our Corporate Governance Guidelines are posted inwith respect to the “SEC Filings” section of our website at www.partech.com/about-us/investors.Board committees on which he or she serves. Our independent Directors are identified as “Independent” in the table on page 510 of this Proxy Statement.

Board Meetings and Attendance. During the 12-month period ended December 31, 2016 (“fiscal 2016”),2019, the Board held eight meetings and took action by unanimous written consent nine times.16 meetings. Each Director attended at least 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of fiscal 20162019 for which he or she was a Director or committee member. It is the Company’s policy to encourage directorsThe Company encourages Directors to attend the annual meetings of stockholders, but such attendance is not required. TwoThree Board members attended the fiscal 2016 Annual Meeting2019 annual meeting of Stockholders.stockholders.

Board Leadership Structure. The Board does not have a Chairman, but rather, Cynthia Russo, whoJames C. Stoffel currently serves as independent Lead Director of our Board. As Lead Director, Mr. Stoffel performs the function of the Chairman of the Board. The Board determinedbelieves that the separation ofseparating the roles of Lead Director and Chief Executive Officer is appropriate asbecause it enables our Chief Executive Officer to focus more closely on the day-to-day operations of PARthe Company while theour Lead Director provides independent leadership to the Board. The Board believes an independentOur Lead Director is better situatedDirector’s independence uniquely situates him to represent the interests of PARour stockholders and to provide independent evaluation of and oversight of our management. He presides over all Board meetings, including executive sessions without the presence of management. The Board also believes that the separation between the offices and functions ofHe regularly communicates with our Chief Executive Officer and Lead Director is consistentliaisons between our non-management Directors and management, including our Chief Executive Officer, to help ensure that our non-management Directors are fully informed and able to discuss and debate among themselves and with best corporate governance practices.management the issues that they deem important.

Board Oversight of Risk Management. TheOur Board does not have a separate risk management committee, butcommittee; rather the full Board manages the risk oversight function, with certain areas addressed by committees of the Board where such risks are inherent in thea committee’s respective area of oversight.purview. In particular, theour Audit Committee oversees our risk guidelines, policies and processes established by management relating to our financial statements and financial reporting processes. The Audit Committee oversees the internal audit function and meets regularly with senior management and our independent public accounting firmauditors concerning our financial statements and financial reporting processes, including our internal control over financial reporting and the effectiveness of such controls and processes. OurThe Audit Committee periodicallyregularly meets with seniormanagement to discuss and assess management’s guidelines and policies with respect to risk assessment and risk management and the full Board to monitor and assess our strategies andmajor financial risk exposure,exposures, including the nature and level of risk appropriate for PAR.the Company and management’s strategies and mitigation efforts. The Audit Committee, typically in joint session with the full Board, alsoregularly meets regularly with and receives periodic reports from our legal,cybersecurity, information technology and compliance and operations groups regarding our systems, data security and compliance with legal and regulatory requirementsmatters. Our Nominating and operational considerations.Governance Committee focuses on risks associated with our corporate governance policies and practices, including related party transactions.

Code of Conduct. Our Code of Conduct (the “Code of Conduct”) is applicable to all our employees, officers, and Directors, including our Chief Executive Officer, Chief Financial Officer, and other senior financial officers. The Code of Conduct is posted on our website at www.partech.com/about-us/sec-filings. Any substantive amendments to the Code of Conduct or waivers granted to our Directors, Chief Executive Officer, Chief Financial Officer, principal accounting officer, controller or other executive officers will be disclosed by posting on our website.

Hedging Transactions. Our Compliance Handbook, which applies to all our employees, officers and Directors prohibits hedging or monetization transactions in our securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds that permit holders to own our securities without the full risks and rewards of ownership.

Corporate Governance Guidelines. Our Corporate Governance Guidelines are posted on our website at www.partech.com/about-us/sec-filings. Our Corporate Governance Guidelines contain independence standards, which are substantially similar to and consistent with the listing standards of the NYSE.

Communication with the Board. Interested parties may send written communication to the Board as a group, the independent Directors as a group, the Lead Director (James C. Stoffel), or to any individual Director by sending the communication c/o Corporate Secretary, PAR Technology Corporation, 8383 Seneca Turnpike, New Hartford, New York 13413. Upon receipt, the communication will be delivered to Director Stoffel (Lead Director) or to the independent Directors as a group. If the communication is addressed to an individual Director, the communication will be delivered to that Director. All communications regarding financial accounting, internal controls, audits, and related matters will be referred to the Audit Committee. Interested parties may communicate anonymously if they so desire.

Committees. Our Board has three committees — Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee — eachCommittee. Each Board committee operates under a written charter that has been approved by the Board. Current copies of each committee’s charter are posted in the “SEC Filings” section ofon our website at www.partech.com/about-us/investors.

sec-filings.The following table provides information about membership (including independence) and committee meetings in fiscal 2016 for each of the Board committees:

| Name | | | Audit(1) | | | Compensation(2) | | | Nominating and Corporate Governance(3) | |

| Paul D. Eurek(4) | | | X | | | X (Chair) | | | X | |

| Donald H. Foley(5) | | | X | | | X | | | X | |

| Todd Tyler | | | X | | | X | | | X (Chair) | |

| Cynthia A. Russo | | | X (Chair) | | | X | | | X | |

| Total meetings in fiscal 2016 | | | 17 | | | 3 | | | 1 | |

Name | Audit Committee (1) | Compensation Committee(2) | Nominating and Corporate Governance Committee(3) | |||

| Douglas G. Rauch | X | X | Chair | |||

| Cynthia A. Russo | Chair | X | X | |||

| James C. Stoffel | X | Chair | X | |||

| Total Meetings in 2019 | 4 | 9 | 4 |

(2), (3)

Compensation Committee. The Compensation Committee oversees and administers our executive compensation program. The Compensation Committee’s responsibilities include:

Reviewing and approving the goals and objectives relevant to our Chief Executive Officer’s compensation and, either as a Committee or (to the extent applicable) with the other independent directors, determineDirectors, determining and approveapproving our Chief Executive Officer’s compensation;

Reviewing, making recommendations to the Board, and overseeing the administration of our compensatory programs, including incentive compensation arrangements;

Reviewing and approving compensation of our executive officers; and

Reviewing and recommending to the Board the compensation for our non-employee directors.Directors.

The Compensation Committee has the authority to retain, oversee and compensate third party compensation consultants, legal counsel, or other advisers to assist the Committee in fulfilling its responsibilities. In 2019, the Committee engaged Pearl Meyer & Partners, LLC (Pearl Meyer) as its compensation consultant to assist it in recommending the form and amount of executive and non-employee Director compensation for 2019. Among other things, with respect to our 2019 compensation program, the Committee asked Pearl Meyer to:

Perform an assessment as to the competitiveness of our executive compensation including total cash compensation (base salary and short-term incentive compensation (cash bonus)) and equity compensation (including structural considerations, equity components and performance matrices), relative to our peer group and broader survey data;

Advise on amendments to our long-term equity incentive plan;

Perform a non-employee director compensation review;

Provide legislative and regulatory updates; and

Provide additional assistance, as requested by the Committee, in analyzing and determining senior officer compensation.

Prior to engaging Pearl Meyer, the Committee considered information relevant to confirm Pearl Meyer’s independence from the Board and management. Additional information regarding the services provided by Pearl Meyer can be found below under “Director Compensation” and “Executive Compensation”.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee assists the Board in meeting its responsibilities by:

Identifying and recommending qualified nominees for election to the Board;

Developing and recommending to the Board a set of corporate governance principles — our Corporate Governance Guidelines; and

Maintaining, monitoring compliance with, and recommending modifications to, our Code of Business Conduct and Ethics.Conduct.

Our Nominating and Corporate Governance Committee reviews possible candidates for the Board and recommends nominees to the Board for approval. The Committee considers potential candidates from many sources including stockholders, current Directors, company officers, employees,management, and others. On occasion, the services of a third party executive search firm are used to assist in identifying and evaluating possible nominees. Stockholder recommendations for possible candidates for the Board should be sent to: Nominating and Corporate Governance Committee, c/o Corporate Secretary, PAR Technology Corporation, 8383 Seneca Turnpike, New Hartford, New York 13413. Regardless of the source of the recommendation, the Nominating and Corporate Governance Committee screens all potential candidates in the same manner. In identifying and considering candidates, the Committee considers the criteria set out in its charter,the Corporate Governance Guidelines, which include specific characteristics, abilities and experience considered relevant to the Company’s businesses, including but not limited to the following:

Skills in areas of perceived need from time to time, which may include government contracting, transportation, technology finance and marketing;

Lack of existing and future commitments that could materially interfere with the member’s obligations to the Company;

Skills compatible with our business objectives; and

Substantial experience outside of personalthe business community, including in the public, academic or scientific communities;

Character and professional experiencesintegrity;

Inquiring mind and background.vision;

Critical temperament; and

Ability to work well with others.

In addition, the Nominating and Corporate Governance Committee considers the requirements set forth in the Corporate Governance Guidelines, as well as the needs of the Company and the range of talent and experience represented on the Board. The Nominating and Corporate Governance Committee selects director candidates without regard to race, color, sex, religion, national origin, age, disability, or any other category protected by state, federal, or local law. When considering a candidate, the Committee will determine whether requesting additional information or an interview is appropriate. The minimum qualifications and specific qualities and skills required for a candidate are set forth in the Company’s Corporate Governance Guidelines and the written charter of the Nominating and Corporate Governance Committee.Committee considers diversity as it relates to differing points of views and experience in in particular fields.

Audit Committee.Our Audit Committee assists the Board in its oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, our independent auditors’ qualifications and independence, and the performance of the internal audit function.

The Audit Committee’s responsibilities include:

Direct oversight of our independent auditor, including appointment, compensation, evaluation, retention, work product, and pre-approval of the scope and fees of the annual audit and any other services, including review, attest, and non-audit services;

Reviewing and discussing the internal audit process, scope of activities and audit results with internal audit;

Reviewing and discussing our quarterly and annual financial statements and earnings releases with management and the independent auditor;

Recommending to the Board that our audited financial statements be included in our Annual Reports on Form 10-K;

Overseeing and monitoring our internal control over financial reporting, disclosure controlsreporting;

Assisting the Board in oversight of our systems, data security and procedures,compliance with legal and Code of Conduct;regulatory matters;

Reviewing and discussing with management its guidelines and policies with respect to risk assessment and risk management and our major financial risk exposureexposures, including the nature and processes;level of risk appropriate for the Company and management’s strategies and mitigation efforts;

Preparing the Audit Committee report required by SEC rules (which is included below).

The Board has determined that each of Ms. Russo and Mr. Tyler is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K of the Exchange Act.

The material in this report is being furnished and shall not be deemed “filed” with SEC for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, nor shall the material in this section be deemed to be “soliciting material” or incorporated by reference in any registration statement or other document filed with the SEC under the Securities Act of 1933 as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

To the Board of Directors of PAR Technology Corporation:

The Audit Committee is responsible for appointing the Company’s independent auditor. For fiscal 2016,2019, BDO USA, LLP (“BDO”) served as the Company’s independent auditor. With respect to the Company’s financial reporting process, management is responsible for establishing and maintaining internal controls and preparing the Company’s consolidated financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”). The responsibility for auditing the Company’s consolidated financial statements and providing an opinion as to whether the Company’s consolidated financial statements fairly present, in all material respects, the consolidated financial position, results of operations and cash flows of the Company in conformity with U.S. GAAP rests with BDO, as the Company’s independent auditor. It is the responsibility of the Audit Committee to oversee these activities. It is not the responsibility of the Audit Committee to prepare or certify the Company’s financial statements or guarantee the audits or reports of BDO.statements. These are the fundamental responsibilities of management and BDO.management.

In the performance of its oversight function, the Audit Committee reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 20162019 with the Company’s management and BDO. In addition, the Audit Committee discussed with BDO, with and without management present, BDO’s evaluation of the overall quality of the Company’s financial reporting. The Audit Committee also discussed with BDO the matters required to be discussed by Statement on Auditing Standards No. 1301, as adopted bythe applicable requirements of the Public Company Accounting Oversight Board.Board and the Securities and Exchange Commission. The Audit Committee also received the written disclosures and the letter from BDO required by applicable requirements of the Public Company Accounting Oversight Board regarding BDO’s communications with the Audit Committee concerning independence and discussed with BDO its independence.

Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016.2019.

| Cynthia Russo (Chair) | |

| Douglas G. Rauch | |

| James C. Stoffel |

| | | | Fiscal Year Ended | | |||||||||

| Type of Fees | | | 2016 | | | 2015 | | ||||||

Audit Fees(1) | | | | $ | 648,728 | | | | | $ | 581,000 | | |

Audit-Related Fees(2) | | | | | | | | | | | | | |

| Tax Fees | | | | | | | | | | | | | |

| All Other Fees | | | | | | | | | | | | | |

| Total: | | | | $ | 648,728 | | | | | $ | 581,000 | | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Stock Ownership of Directors and Officers

The tables below set forth, as of April 24, 2017,March 27, 2020, information regarding beneficial ownership of our common stock.

Beneficial ownership is determined according to the rules of the SEC and generally means that a person has beneficial ownership of our common stock if he, she, or it possesses sole or shared voting or investment power of the common stock or has the right to acquire beneficial ownership of our common stock within 60 days. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the tables below have or will have sole voting and investment power with respect to all shares of common stock shown that they beneficially own, subject to community property laws where applicable.

Our calculation of the percentage of beneficial ownership is based on 15,774,60418,275,044 shares of our common stock outstanding as of April 24, 2017.March 27, 2020. Common stock subject to stock options currently exercisable or exercisable within 60 days of April 24, 2017March 27, 2020 is deemed to be outstanding for computing the percentage ownership of the person holding these options and the percentage ownership of any group of which the holder is a member but is not deemed outstanding for computing the percentage of any other person.

The information in the tables belowtable is based onupon information supplied by officers, directorsDirectors and principal stockholders, Schedules 13D, 13G and 13G/A filed with the SEC and other SEC filings made pursuant to Section 16 of the Exchange Act. Except as otherwise indicated in the tables below, addresses of named beneficial owners are c/o PAR Technology Corporation, 8383 New Hartford, New York 13413-4991.

The following table sets forth the beneficial ownership of our common stock by our (1) Directors, (2) Named Executive Officers (“NEOs”),named executive officers, and (3) Directors and current executive officers as a group as of April 24, 2017.March 27, 2020.

| Name of Beneficial Owner | | | Amount and Nature of Beneficial Ownership | | | Percent of Class | | ||||||

| Directors | | | | | | | | | | | | | |

| Dr. John W. Sammon | | | | | 4,622,081(1) | | | | | | 29.3% | | |

| Paul D. Eurek | | | | | 24,572 | | | | | | * | | |

| Dr. Donald H. Foley | | | | | 37,955 | | | | | | * | | |

| Cynthia A. Russo | | | | | 17,397 | | | | | | * | | |

| Todd E. Tyler | | | | | 24,572 | | | | | | * | | |

| Named Executive Officers | | | | | | | | | | | | | |

| Karen E. Sammon | | | | | 735,317(2) | | | | | | 4.6% | | |

| Matthew R. Cicchinelli | | | | | 30,238(3) | | | | | | * | | |

| Matthew J. Trinkaus | | | | | 3,748(4) | | | | | | * | | |

| All Directors and current executive officers as a group (7 persons) | | | | | 4,756,815 | | | | | | 30% | | |

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

| Directors | |||||||||

| John W. Sammon | 2,106,214 | (1) | 11.5 | % | |||||

| Savneet Singh | See holdings below | * | |||||||

| Douglas G. Rauch | 10,725 | * | |||||||

| Cynthia A. Russo | 30,985 | * | |||||||

| James C. Stoffel | 10,725 | * | |||||||

| Named Executive Officers | |||||||||

| Savneet Singh | 103,815 | * | |||||||

| Bryan A. Menar | 27,396 | (2) | * | ||||||

| Matthew R. Cicchinelli | 22,502 | (3) | * | ||||||

| All Directors and current executive officers as a group (7 persons) | 2,312,362 | 12.6 | % | ||||||

| * | Less than 1% |

(1) | See footnote (1) to the “Stock Ownership of Certain Beneficial Owners” table below. |

(2) | Includes 21,062 shares subject to a currently exercisable stock option. |

(3) | Includes 3,062 shares subject to a currently exercisable stock option. |

14

Stock Ownership of Certain Beneficial Owners

The following table provides information regarding the beneficial ownership of each person known by us to beneficially own more than 5% of our common stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

John W. Sammon c/o PAR Technology Corporation 8383 Seneca Turnpike New Hartford, NY 13413-4991 | 2,106,214 | (1) | 11.5 | % | |||||

Section 16(a) of the Exchange Act requires our executive officers, directors,Directors, and stockholders who beneficially own more than 10% of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Based solely on a review of reports filed with the SEC and written representations that no other reports were required, we believe that our executive officers, directorsduring 2019 Savneet Singh filed one late Form 4 reflecting one late equity grant transaction and greater than 10% stockholders complied with all applicable filing requirements on a timely basis during fiscal 2016, except for Ronald J. Casciano, whoBryan A. Menar and Matthew R. Cicchinelli each filed a late Form 4 reflecting one late transaction disclosing notice of satisfaction of performance targets associated with shares eligible to reflect four late reports and four late transactions related to forfeitures of 60,334 shares of restricted stock that occurred on January 1, 2015, March 15, 2015, March 15, 2016, and March 15, 2017.vest at a later date, December 31, 2020.

2019 Director Compensation

During 2019 compensation for non-employee Directors who are employeesconsisted of a mix of cash and equity. In March 2019, Pearl Meyer provided the Compensation Committee with an analysis of non-employee director compensation, including a review of director compensation of the Company are not separately compensatedCompany’s peer group (the “Pearl Meyer Director Compensation Report”). The peer group for servingthis analysis consisted of the same comparator group that is used to evaluate executive compensation and is described below under “Executive Compensation —Market Data and Other Compensation Considerations.”

Based on the Board. For fiscal 2016, compensation for non-management directors consistedPearl Meyer Director Compensation Report, the Compensation Committee recommended to the Board of Directors that non-employee Directors elected at the 2019 Annual Meeting be paid cash retainers based on committee membership in addition to a fixed annual cash retainer. Previously, non-employee Directors received an annual cash retainer of $40,000, with nothe Audit Committee chairperson receiving an additional $5,000 cash retainer. Our non-employee Directors do not receive additional fees for Board or committee meeting attendance orattendance. Beginning in June 2019, non-employee Directors received the following cash retainers for their service on the Board and committee membership, except Ms. Russo waswhich are paid quarterly in arrears:

| Position | Cash Retainer (Board & Committee) | |||

Non-Employee Director | $ | 40,000 | ||

Lead Director | $ | 18,000 | ||

Audit Committee, Chair | $ | 18,000 | ||

Audit Committee, Member | $ | 9,000 | ||

Compensation Committee, Chair | $ | 10,000 | ||

Compensation Committee, Member | $ | 5,000 | ||

Nominating & Corporate Governance Committee, Chair | $ | 7,500 | ||

Nominating & Corporate Governance Committee, Member | $ | 3,750 | ||

Each non-employee Director received an additional $5,000 (cash) retainer for serving as Lead Director and Chair of the Audit Committee. Independent directors were also granted anannual award of restricted stock with 100% vestinga grant date fair value of $90,000, which represented a $15,000 increase over the grant date fair value of the previous year’s award. The Compensation Committee recommended this increase to the Board based on May 1, 2017. All directorsthe Pearl Meyer Director Compensation Report. The 2019 annual grant was based on the closing price of our common stock on June 10, 2019 ($29.35), the grant date, and resulted in a grant of 3,066 shares of restricted stock, which will vest on the earlier of June 10, 2020 and the date of the 2020 Annual Meeting. The 2019 grants were reimbursedmade under the Amended and Restated PAR Technology Corporation 2015 Equity Incentive Plan (the “2015 Equity Incentive Plan”).

We reimburse our non-employee Directors for reasonable expenses incurred in attendingto attend Board and Committee meetings.

| Name of Director | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($) (2) | All Other Compensation ($) | Total ($) | ||||||||||||

Douglas G. Rauch | 51,944 | 90,000 | --- | 141,944 | ||||||||||||

Cynthia A. Russo | 61,149 | 90,000 | --- | 151,149 | ||||||||||||

John W. Sammon | 46,250 | 90,000 | --- | 136,250 | ||||||||||||

James C. Stoffel | 58,572 | 90,000 | --- | 148,572 | ||||||||||||

(1) Compensation is pro-rated for the number of days served on the Board and independent directors during fiscal 2016.

| Name of Director | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | All Other Compensation ($) | | | Total ($) | | ||||||||||||

Ronald J. Casciano(2) | | | | | 40,000 | | | | | | 56,727 | | | | | | — | | | | | | 96,727 | | |

Dr. Donald H. Foley(3) | | | | | 40,000 | | | | | | 56,727 | | | | | | — | | | | | | 96,727 | | |

Paul D. Eurek(4) | | | | | 40,000 | | | | | | 40,043 | | | | | | — | | | | | | 80,043 | | |

Cynthia A. Russo(5) | | | | | 45,000 | | | | | | 40,043 | | | | | | 15,000 | | | | | | 100,043 | | |

Dr. John W. Sammon(6) | | | | | 65,000 | | | | | | — | | | | | | — | | | | | | 65,000 | | |

Todd E. Tyler(7) | | | | | 40,000 | | | | | | 40,043 | | | | | | — | | | | | | 80,043 | | |

Stock Ownership Guidelines for Non-employee Directors

Directors are required to hold shares of the Company’s common stock granted on May 5, 2016 and on May 18, 2016. On May 5, 2016, Directors Casciano and Foley were each granted 3,017with a fair market value equal to 3x the amount of the annual cash retainer payable to the non-employee Director. All shares of restricted common stock bought by a non-employee Director or the Director’s immediate family member residing in considerationthe same household, all shares held in trust for the benefit of $.02 per share (par value);a non-employee Director or his or her family, and all shares granted under the grant date fair value2015 Equity Incentive Plan count toward the satisfaction of these shares was $5.53 per share; the shares vested on grant. On May 18, 2016, Directors Casciano, Foley, Eurek, Russo and Tyler were each granted 8,859 shares of restricted common stock in consideration of $.02 per share (par value); the grant date fair value of these shares was $4.52 per share; these shares vest 100% on May 1, 2017.

16

We are a “smallereligible to rely on the scaled disclosure requirements for smaller reporting company,” as that term is definedcompanies under Item 402 (m) through (q) of Regulation S-K in Rule 12b-2 of the Exchange Act, as suchthis proxy statement. Under these scaled disclosure requirements, we are required to disclose certain compensation information about our (1) Chief Executive Officer (2) each of our(CEO) and two other individuals serving as executive officers who were the most highly compensated executive officers whose total compensation for fiscal 2016 was in excess of $100,000 and who were serving asthe Company. Our named executive officers at the end of 2016, and (3) up to two additional individuals for whom we would have provided disclosure based on their total compensation for fiscal 2016, but for the fact they were not serving as executive officers as of December 31, 2016. Accordingly, our “Named Executive Officers” as of December 31, 2016 are:during 2019 were:

| Named Executive | ||||

Chief Executive Officer and President of the Company and President of ParTech, Inc. | ||||

| Bryan A. Menar | Chief | |||

| Matthew R. Cicchinelli | President of PAR Government Systems Corporation and Rome Research Corporation |

(1)

Compensation Objective and Methods.

The objective of our executive compensation program is to structure programs thatdrive the creation of stockholder value. To do this, we have designed an executive compensation program to attract, retain, and motivate executive officerstalented people who can deliver competitive financial returns to grow our revenuesstockholders through the achievement of short-term and profitslong-term goals; to create long-term value for our stockholders. To achieve this our compensation programs have been designed and implemented to (i) reward executive officers for operational performance and leadership, (ii) align our executive officers’ interests with our stockholders, and (iii) encourage our executive officers to remain with the Company.we maintain:

Competitive Compensation, we provide compensation opportunities that take into account compensation levels and practices of our peers, but without targeting any specific percentile of relative compensation; instead our compensation program is designed to reward top performers in a highly competitive market for talent and align their interests with the interests of our stockholders.

In 2019, we entered into a new employment agreement with Savneet Singh in connection with his appointment to the office of CEO and President of the Company and President of ParTech, Inc. His employment agreement is described in further detail below. In addition, our Compensation Committee reviewed and revised our annual and long-term incentive metrics and payout structures to better tie individual and corporate performance, in a way that is aligned with the short- and long-term interests of the Company and its stockholders. The Committee believes the revised plans, described further below, create incentives and accountability for our named executive officers to achieve our overallstrategic and financial goals in furtherance of stockholder value.

Role of the Compensation Committee and CEO.

The Compensation Committee approves the annual compensation of our non-CEO named executive officers and certain other senior officers of the Company, including incentive compensation (cash and equity based). However, our CEO provides information and recommendations to the Compensation Committee on the compensation and performance goalsof our other named executive officers, including recommendations as approved byto the Board,appropriate levels of base salaries, short-term incentive compensation and long-term equity awards, performance targets for corporate and other operating segments, and individual performance targets.

With respect to the compensation of the CEO, Pearl Meyer worked directly with the Compensation Committee to develop the compensation program for the CEO. The CEO does not make recommendations on his base salary or the mix and/or structure of his short-term cash incentive or long-term equity incentive compensation.

Role of Compensation Consultant

The Compensation Committee has engaged Pearl Meyer as its consultant to provide information and advice concerning executive and non-employee director compensation. The Compensation Committee believes that Pearl Meyer has the necessary skills, knowledge, industry expertise, and experience, as well as the performance objectivesnecessary resources, to provide a comprehensive approach to executive and non-employee director compensation analysis, planning and strategy. Pearl Meyer provides advice related to executive and non-employee director compensation as requested, including an annual analysis of executive and non-employee director compensation compared to peer company practice and data. Pearl Meyer may also provide input on management materials and recommendations in advance of Compensation Committee meetings.

In late 2018, Pearl Meyer conducted an executive compensation study and provided the Compensation Committee with an analysis of our executive compensation and program design for 2019, including comparator peer group compensation data for our named executive officers and other back-up information and analysis of compensation matters as requested by the Compensation Committee.

While the Compensation Committee considers the reports, data, and analyses provided by Peal Meyer, the Compensation Committee is the ultimate decision-making authority with respect to our compensation programs, including the specific amounts paid to our named executive officers. Accordingly, as discussed above under “Director Compensation,” we restructured and increased our non-employee Director compensation in 2019, and

the base salary of Savneet Singh, our CEO, was increased in March 2019, pursuant to his March 22, 2019 employment agreement and the base salaries of other named executive officers, Bryan Menar, our CFO, and Matt Cicchinelli, President of PAR Government, were not changed;

our short-term and long-term incentive programs were modified to create a stronger relationship of pay to performance;

each of Messrs. Singh, Menar and Cicchinelli participated in our employees,2019 short-term incentive program; and

Mr. Singh was awarded equity pursuant to his March 22, 2019 employment agreement and Messrs. Menar and Cicchinelli were awarded equity pursuant to our 2019 long-term incentive program.

Market Data and Other Compensation Considerations

In response to our Compensation Committee’s request that Pearl Meyer perform an assessment of our executive compensation, including executive officers;

In addition to market and survey data, the Compensation Committee considered each named executive officer’s individual expertise, skills, responsibilities, required commitment, current and anticipated contribution to the Company’s achievement of its plans and goals, as well as prior compensation adjustments, prior award accumulation, and any contractual commitments, in formulating the 2019 compensation of our named executive officers.

Elements of 2019 Executive Compensation

Our 2019 executive compensation program is designed to retain and motivate our named executive officers, in accordance withand to promote the following overriding policies:

Base Salary. In setting the annual base salary of our Chief Executive OfficerCEO, and in reviewing and approving the annual base salaries of the other named executive officers, the Compensation Committee considered information from Pearl Meyer and other factors described above under “Market Data and Other Compensation Considerations”. Messrs. Menar and Cicchinelli did not receive a base salary increase in 2019 based on the salariesCompany’s financial performance for the fiscal year ended 2018. Mr. Singh’s base salary until mid-March 2019 was $473,000, on March 22, 2019, Mr. Singh’s base salary was increased to $490,000 pursuant to his employment agreement dated March 22, 2019.

Bonuses. Mr. Cicchinelli participates in an employee retention program used by PAR Government as a tool to recruit and retain certain of executivesits employees and those of its subsidiaries (the “PGSC retention bonus”), which is generally available to all employees of PAR Government and its subsidiaries who are not covered by the Service Contract Act. The PGSC retention bonus is a percentage of an employee’s total cash compensation paid in similar positions,a fiscal year; it is established annually by PAR Government’s senior management, and is payable, if the levelemployee remains employed through and scope of responsibility, experience and performanceincluding the payment date, in the immediately following year, generally on or about March 31. The payment is reduced by the amount, if any, of the individual executive officers,employer contribution for the financial performanceemployee to the profit-sharing component of the CompanyCompany’s retirement plan. In 2019, Mr. Cicchinelli earned a PGSC retention bonus of $17,304 and other overall general economic factors. The Compensation Committee also referenced the benchmark data when reviewing annual base salaries.a $20,000 discretionary cash award in consideration for his individual contributions to PAR Government.

| Named Executive Officer | Target STI as percentage of earned base salary | |||

Savneet Singh | 90% | |||

Bryan A. Menar | 40% | |||

Matthew R. Cicchinelli | 55% | |||

The 2019 annual STI targets for Messrs. Singh and Menar were divided equally between corporate and business goals and individual performance goals. As shown in the table below, corporate and business goals for Messrs. Singh and Menar were weighted equally among our Brink line of business, Core line of business, and consolidated corporate results. Mr. Cicchinelli’s 2019 annual STI target was based entirely upon the PAR Government financial goal.

Performance Goals | ||||||||||||||||||||

| Corporate | Brink | Core | PAR Government | Individual Goals | ||||||||||||||||

| Target Performance | Consolidated Adjusted EBITDA(1) | Annual recurring revenue | Profit before tax(2) | Net income before taxes | Individual performance goals tied to Company goals | |||||||||||||||

| Weighting of Each Performance Metric | ||||||||||||||||||||

Savneet Singh | 16.67% | 16.67% | 16.66% | -- | 50% | |||||||||||||||

Bryan A. Menar | 16.67% | 16.67% | 16.66% | -- | 50% | |||||||||||||||

Matthew R. Cicchinelli | -- | -- | -- | 100% | -- | |||||||||||||||

(1) Corporate/Consolidated Non-GAAP Adjusted EBITDA is our net income/(loss), excluding net interest, amortization of identifiable intangible assets, depreciation of fixed assets and income taxes as shown in our Consolidated Statement of Operations in the Company’s Annual Report on PAR’sForm 10-K filed with the SEC on March 16, 2020, excluding extraordinary items such as performance from recent acquisitions and costs related to recent divestitures not considered within the 2019 Annual Operating Plan performance targets.

(2) CORE/ Profit before tax, is that business line’s respective profit before tax excluding indirect allocated costs from corporate home office and support shared services.

The actual STI payout depends upon the level of achievement against the selected performance goals, as set forth below. There will be no STI payout, regardless of the achievement of a particular corporate, business or subsidiary target, unless a minimum of 85% of a non-GAAP profit before taxes (PBT) goal is met.

The corporate and business performance targets and actual achievement for 2019 were as follows:

STI Level of Achievement | Corporate – Consolidated Adjusted EBITDA: | Brink – Annual recurring revenue | Core – Profit before tax | PAR Government – Net income before tax | |||||||||

| Threshold | $ | 186,300 | $ | 18.7 million | $ | 9.4 million | $ | 6.30 million | |||||

| Target | $ | 207,000 | $ | 20.8 million | $ | 10.4 million | $ | 7.01 million | |||||

| Maximum | $ | 248,400 | $ | 25.0 million | $ | 12.5 million | $ | 8.40 million | |||||

| Actual Performance Achieved | $( | 2.7 million) | $ | 18.9 million | $ | 10.9 million | $ | 5.35 million | |||||

Potential payouts as a percentage of 80% to 120% of corporate PBTthe targets established by the Board and (2) Mr. Trinkaus’ individual bonus target for fiscal 2016 performance was 15% (below PBT target), 25% (at PBT target) and 35% (above PBT target) of hisearned base salary depending on PAR’s actual achievementwere - Threshold: 50%, Target: 100% and Maximum: 150%. In 2019, the named executive officers earned their STI as follows:

| Named Executive Officer | STI Payout ($) | STI Payout as a percent of target achieved (%) | STI Payout as a percent of earned base salary (%) | |||||||||

Savneet Singh | 448,862 | 102.6 | 92.3 | |||||||||

Bryan A. Menar | 115,173 | 106.2 | 42.5 | |||||||||

Matthew R. Cicchinelli | -- | 0 | 0 | |||||||||

In 2019, we granted the following LTI awards to Messrs. Menar and Cicchinelli:

| Name | Time Vesting Restricted Stock | Performance Vesting Restricted Stock (Target) | Non-Qualified Stock Options | |||||||||

Bryan A. Menar | 1,005 | 1,608 | 5,382 | |||||||||

Matthew R. Cicchinelli | 753 | 1,206 | 4,036 | |||||||||

The time vesting restricted stock vests ratably in one-third increments on December 31, 2019, December 31, 2020, and December 31, 2021, subject to continuing employment on the applicable vesting dates.

The non-qualified stock options awarded as 2016 LTI, generally: vest ratably in one-third increments on August 9, 2020, August 9, 2021, and August 9, 2022, subject to continuing employment on the anniversary of the grant date over three years; must be held for one year afterapplicable vesting before the underlying shares may be sold; and on the effective date of a change in control, one-third will vest, to the extent outstanding and unvested. dates.

The performance vesting restricted stock awarded as 2016 LTI, generally: vestvests ratably in one-third increments on December 31, 2019, December 31, 2020, and December 31, 2021, based on the third-year anniversarypercentage annual performance targets are achieved for the applicable performance year and subject to the named executive officer’s continuing employment on the applicable vesting dates.

For the performance year ended December 31, 2019 (the “2019 Performance Year”), performance is based on the Company’s total shareholder return (“TSR”) ranking, as compared to the other companies in the Russell 2000 Index (the “peer group”). TSR is the change in stock price between January 1, 2019 and December 31, 2019 (“measurement period”) and is determined based on the quotient of the grant date, but onlyending average share price over the beginning average share price, minus 1, where the average share price of the Company’s common stock and each other company in the peer group is the average closing stock price over the 20 trading days ended January 1, 2019 and ending December 31, 2019. At the end of the measurement period the Company’s TSR and the TSR of each other company in the peer group is ranked from highest to lowest, with the company with the highest TSR being assigned a rank of 1.

The total percentage of shares of performance-vesting restricted stock that may vest in the 2019 Performance Year is capped at 150% and is calculated by multiplying the number of shares of performance-vesting restricted stock eligible to vest in the 2019 Performance Year by the payout percentage corresponding to the Company’s TSR percentile ranking for 2019. If the Company’s TSR is negative during the 2019 Performance Year, the maximum number of shares of performance-vesting restricted stock that can vest is 100%, even if the fiscal 2016 corporate PBT target established byCompany’s TSR is above the Board is achieved and50th percentile of the recipient remains employedRussell 2000 Index.

For the 2019 Performance Year, the Company’s percentile ranking for three years fromTSR against the other companies in the Russell 2000 Index was 87%, which resulted in 150% of the performance vesting shares being earned for the 2019 Performance Year.

| Company’s TSR Relative to the Russell 2000 Index | Percent of Performance Vesting Restricted Stock to Vest (“payout percentage”) | ||

At or above 75th percentile | 150% | ||

At or between 50th – 74th percentile | 100% | ||

At or between 25th – 49th percentile | 25% | ||

At or between 0-24th percentile | 0% |

In addition to the grants described above, the Compensation Committee approved a discretionary retention grant of 10,000 shares of restricted stock to Mr. Cicchinelli; 2,500 shares vested on the date of grant, (“3-year cliff vesting”)2,500 shares vested on January 1, 2020, and in5,000 shares will vest on January 1, 2021, subject to Mr. Cicchinelli’s continuing employment through the eventapplicable vesting date.

In 2019, we granted 20,000 shares of a change of controltime vesting restricted stock and a subsequent involuntary termination of employment, without cause, vest 100%. Ms. Sammon was granted 4,00080,000 shares of performance vesting restricted stock with 3-year cliff vesting;to Mr. Cicchinelli was granted 5,000 shares of performance vesting restricted stock with 3-year cliff vesting; and Mr. Trinkaus was granted 2,000 shares of performance vesting restricted stock with 3-year cliff vesting. Mr. Trinkaus was also granted non-qualified stock options for 5,000 shares of common stock, that vest ratably over three years, commencing onSingh under the first anniversary of the grant date. The terms and conditions of the LTI awards also include customary restrictions on transfer, non-solicitation and non-recruitment restrictions for one year following termination of employment, and “claw back” (i.e. reversal of an award) provisions in the event vesting or profits are later determined by the Board to have resulted from materially inaccurate financial information.

Benefits. The Company provides partial paymentOur named executive officers are eligible for medical, dental and vision insurance,the same benefits available to our other full-time employees. Our benefits include our 401(k)/retirement plan with profit sharing and disability(“retirement plan”), employee stock purchase plan, health and life insurance benefits to its Named Executive Officers consistent with that offered generally to all employees.

Deferred Compensation. We sponsor a Non-Qualified Deferred Compensation Plannon-qualified deferred compensation plan for a select group of highly compensated employees that includes certain of our Named Executive Officers.named executive officers. Participants may make voluntary deferrals of their salary and/or cash bonus to the plan. The Board also has the sole discretion to make employer contributions to the plan, although it did not make any such employer contributions in fiscal 2016.2019.

Employment and Severance AgreementsArrangements in effect for 2019

Savneet Singh. In connection with thathis appointment Ms. Sammon entered into an amendment to her employment agreement dated November 16, 2015 (the “November 2015 employment agreement”) to reflect her change in office. Pursuant to the November 2015 employment agreement, Ms. Sammon had been appointed to the positions of President andas Interim Chief Executive Officer and President of the Company effective January 1, 2016. Under the 2015December 4, 2018, we entered into an employment agreement, Ms. Sammon’s employment is “at will”, and the agreement provides the following compensation components: (1)letter with Mr. Singh, which provided for an annual base salary of $300,000; (2) participation$473,500 (which was pro-rated for 2018). Pursuant to the employment letter Mr. Singh was granted 5,000 shares of performance based restricted stock under the 2015 Equity Incentive Plan.

In connection with his appointment as Chief Executive Officer and President of the Company effective March 22, 2019, we entered into a new employment agreement with Mr. Singh. The March 2019 employment agreement superseded and preempted the terms of the December 2018 employment letter (including cancelling the 5,000 performance shares described above). The March 2019 employment agreement provided for an annual base salary of $490,000, an STI bonus target equal to 90% of his base salary earned in 2019, 20,000 shares of restricted stock that vest on March 31, 2020, subject to his continued service, and 80,000 shares of performance vesting restricted stock as described above under “Long-Term Incentive (“LTI”) Compensation”. The March 2019 employment agreement further provided that for each of 2020 and 2021, Mr. Singh would be eligible to receive an award of 90,000 shares of performance vesting restricted stock that would become earned to the extent performance goals established by the Compensation Committee are satisfied, and then, so long as he remained continuously employed as Chief Executive Officer, fully vested on the third anniversary date thereafter. In accordance with the Company’s reimbursement policy, Mr. Singh was eligible for reimbursement of travel and other expenses, including up to $35,000 in reimbursement for housing and living expenses.

On February 27, 2020, we entered into a new employment agreement with Mr. Singh. The February 2020 employment agreement supersedes and preempts the March 2019 employment letter and is further described in our short-term incentive compensation,Current Report on Form 8-K filed with the SEC on March 2, 2020 and is filed as Exhibit 10.20 to our Annual Report on Form 10-K for our fiscal year ended December 31, 2019. The terms of the February 2020 employment offer letter will be further described in our proxy statement for the 2021 annual meeting of stockholders.